Adapting to client needs: Why wealth managers and family offices should consider offering their clients digital lending products

The recent “2021 EY Global Wealth Research Report”1 looks at changes in client needs when it comes to wealth management. The research highlights a need for digitalization, diversification, alternative investments, and a focus on asset preservation. How do digital lending products fit in this picture and how can financial advisors, wealth managers, and family offices adapt to these new challenges?

The Global Wealth Research Report gathered its insights by interviewing 2’500 investors (UHNW, VHNW, HNW, Affluent)2 across 21 geographies. The sample was also diversified in terms of not only segments such as age, gender, place of residence, and wealth, but also risk appetite, life stages, profession, sexual orientation, race, and ethnicity.

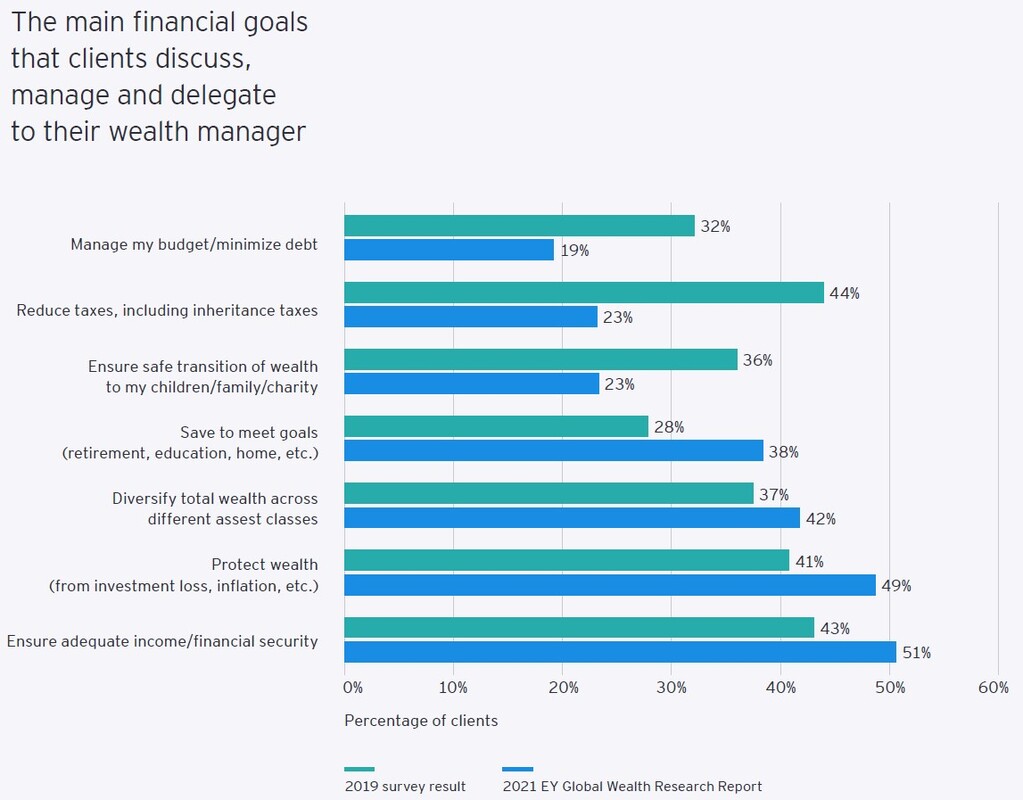

One interesting key takeaway was that, in the wake of the tumultuous year 2020, a key shift highlighting a focus on asset preservation and security was noticeable across all investors. This is also amidst the traditionally more risk-tolerant younger generations. A notable factor herein was the fact that a total of 42% of clients (5% up from 2019) discussed, managed, and delegated to their wealth manager the diversity of their portfolio across different asset classes (Fig.1).

Furthermore, clients are posed to embrace more digital offers and investment-related FinTech services. "This development manifests itself globally but is most noticeable in Europe which shows rapid innovation acceleration. In contrast, retail banks continue to fall out of favor with clients, although North America bucks this trend.”1

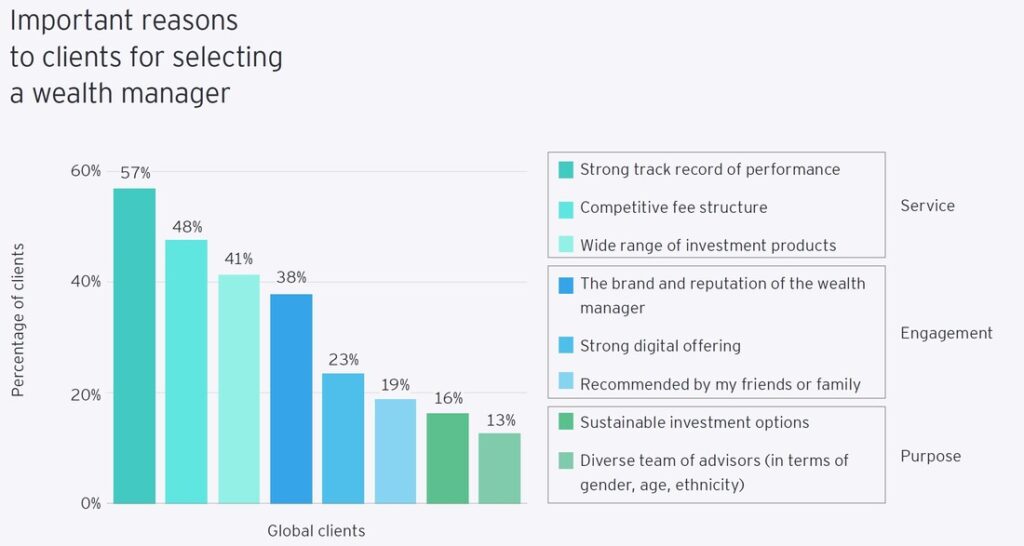

The report highlights three areas that will be key to increasing the financial well-being of clients. One amongst those is a broadly diversified approach to investments, with 41% of participants indicating this as a core aspect for them (Fig. 2). This means that investors recognise the value in a broader spectrum of products. More specifically, investors expect to “diversify the financial products they use from an average of 4.1 product types today to 5.5 by 2024”1. This trend is strongest with millennials, who expect to use an average of 6.1 products by the same time.

At the core of this development is the anticipated much stronger use of alternative investments amongst investors. Where one-third of clients invest in alternatives nowadays, the number is expected to skyrocket to 48% by 2024. Interestingly these kinds of investments are not perceived as contrary to the increase in risk aversion amongst the clients, particularly those belonging to the millennial generation.

Lastly, the need for digitalisation that is at the core of my recent developments expands into the servicing of clients too. Here most clients indicate a preference of hybrid models that allow them digital access in certain areas, while personal contact with the advisor is still the way to go for other situations such as receiving financial advice. The area in which digital preference is clearly preferred is the monitoring and analyzing of results, with a majority of 66% indicating they prefer digital means.

These developments point strongly towards the necessity for wealth managers of all sorts to more profoundly include not only alternative investments but also digitalisation. Digital/Crowd/Marketplace lending poses an excellent opportunity in this regard. The asset class shows a remarkably low correlation with other asset classes and therefore lends itself to diversifying a portfolio.

What opportunities can i2 Group offer Asset managers, independent advisors, and family offices in this regard?

In line with the diversification aspect, it is important to keep in mind that this should not only refer to the asset classes themselves but also to the respective products in each asset class. This means that a product that suits clients needs is to be diversified not only across a multitude of platforms but also across loan types, geographies, and many more factors such as collateralisation. In order to achieve this, a digitalised approach is an absolute necessity. i2 Group is not only able to provide professionals with the necessary consulting expertise, but can also offer access to our proprietary software that allows us to make diversified investments in marketplace loans according to the clients wishes. Furthermore, it also helps with monitoring, risk assessment, due diligence, and auditing.

Furthermore, i2 group offers ready-made financial products through our own distribution as well as our network of partners for whom we already have created a selection of marketplace lending-based products with different profiles. Lastly, we can assist in the creation of tailor-made financial products for clients thanks to our access to our structuring platform. This enables us to simplify the entire process and to offer professionals highly adaptable solutions to create investment opportunities for their clients according to their very specific wishes.

[1] https://www.ey.com/en_ch/wealth-management-research

[2] Wealth segmets (assets) - UHNW: US$30m+, VHNW US$5m-US$29.9m, HNW US$1m-US$4.9m, Affuluent US$250k-US$1m