Buy now, pay later (BNPL) has gained massive popularity, especially among the younger generations. As a survey in 2021 of 2000 Americans has shown that, about 56 % have already used BNPL at least once[1]. But what exactly is Buy Now Pay Later, why has it gained in popularity and how bright is the future of this sector looking?

What is buy, now pay later?

The idea behind the name is pretty self-explanatory: the term refers to a form of short-term financing that allows consumers to make a purchase and pay for it at a later date, often with no interest. Another term sometimes used for this concept is “point of sale installment loans”. This concept is particularly popular amongst online retailers[2]. The concept is not entirely new. Many have experienced paying for large electronics purchases such as e.g. a TV in installments. However, with luxury goods or everyday consumables from online shopping, this has been less popular so far. But where did this trend come from?

Popularity among younger generations

Especially students or young people, in general, follow the hype of BNPL [Fig. 1]. This trend comes as no surprise as, since 2002 many young people have turned their backs on credit cards or cash [Fig. 2].[3]

Players in the market

Since its beginning in 2014, many new players have joined this fast-growing field. Alma, Zilch, and Scalapay are just a few startups that joined the race in 2021. Paypal, for example, has started aggressively pushing BNPL with their new feature “Pay in 4”. Bloomberg just recently announced that Apple is also working on a new service called Apple Pay Later. This feature will enable Apple customers to purchase in installments over time. Besides those public companies, there are many others like Klarna, Affirm or Afterpay which are mostly focusing on BNPL.

Criticism of BNPL

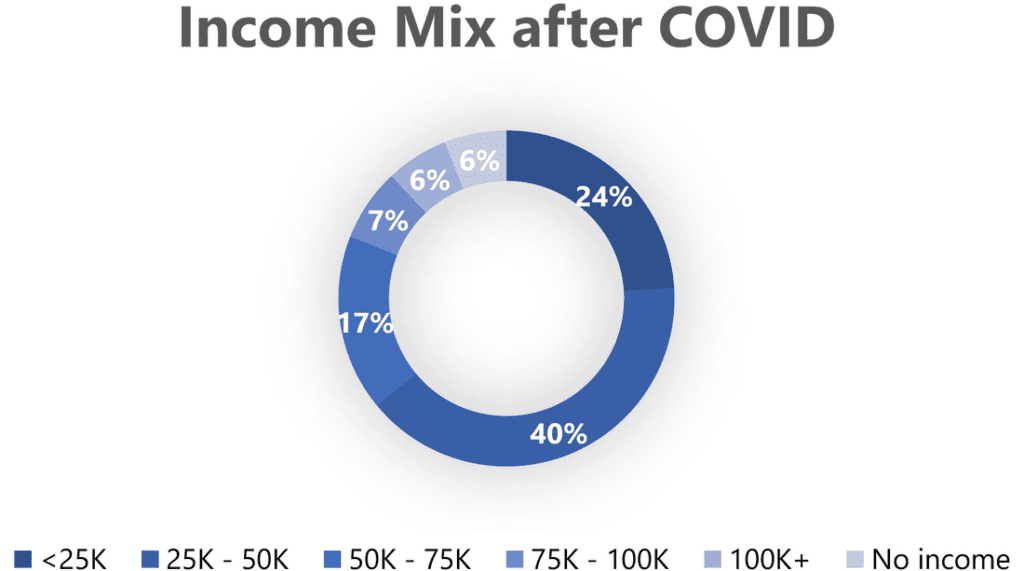

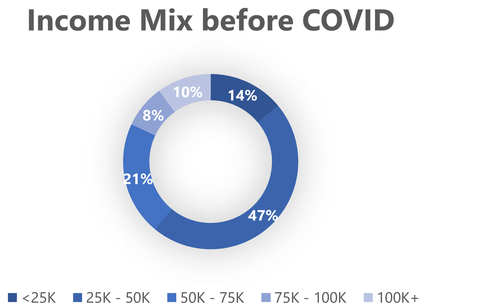

For many people, liquidity was and is - especially during the COVID-19 pandemic - a big problem. Therefore those short-term loans are very attractive to them. The percentage of people with smaller yearly incomes who use BNPL has increased compared to the previous year(s) [Fig. 3 & 4]. For instance, pre-COVID-19 people who earn under 25k $ annually only made up 14 % of BNPL users, whereas this number has increased by 10 % to a total of 24 % post-COVID-19. This does not necessarily mean that they aren’t as creditworthy as others. But to quote Dan Lane from Christians against poverty: "If you can't afford the product today - why do you think you could afford it in 30,60 or 90 days time?"

Many of these customers can’t qualify for a credit card. No or low income, Recent late payments, or past delinquencies may be reasons for not being granted a credit card. Consequently, it could be assumed that the likelihood of late or outstanding payments in these customers would be higher. For the concerned consumers, this can bring the additional pressure of payback, fees as well as hefty interest charges.

Positive aspects for consumers

BNPL is also a reasonable solution for consumers, who can’t qualify for a credit card or don’t want one. Additionally, the credit approval system of BNPL is usually less cumbersome. This could however be seen as a double-edged sword.

It is, however, not all negative. As many as 44% of BNPL service users indicated convenience and ease of availability as one of the many pros for them. The ability to spread costs by cutting the amount into small pieces was also highly appreciated.

Positive aspects for merchants

Not only consumers can benefit from the many possibilities and advantages BNPL has to offer. Klarna for example states that the implementation of BNPL has led to an increase of 33 % in the values of sales at one of his clients. Additionally, this gives certain customers the opportunity to afford an expensive item or product through installment payments, which they would not have been able to buy. Furthermore, the availability of a BNPL payment option has been shown to increase the likelihood of returning customers on the same website, as customers value this service.

This supports the result of a survey from finder which has shown that about 9.5 Million Brits said that they avoided buying from merchants that don’t offer the BNPL option[4].

BNPL = credit card?

Even though there are major similarities between credit cards and BNPL, there are however a few key differences. Firstly, since most of the BNPL platforms don’t charge interest on their purchase, they don’t fall under the National Consumer Credit Protection Act. Another difference can be seen in the flexibility offered by the service. If something is bought via credit card, the full amount is billed at month’s end. This changes with BNPL. As previously mentioned this payment method allows you to stretch out the due payments over a prolonged period of time.

On the other hand, a credit card makes up for this missing flexibility by being more broadly accepted. BNPL is for now mostly accessible on selected websites online. Credit cards have a much wider use online and can furthermore be used at almost any offline store such as grocery stores or fuel stations.

Having a credit card also comes with other benefits such as cashback, insurance, or purchase protection, just to name a few of them. Buying with BNPL doesn’t come with such benefits. Sometimes not even credit reporting is offered. Finally, though, many consumers have remarked that BNPL is more intuitive than buying with a credit card.

So in conclusion one of the big points BNPL has going for itself is its intuitive interface which leads to an improved consumer experience.

If the BNPL industry can leverage the aforementioned strengths while working on potential downsides we see a net positive in this technology for consumers, retailers as well as investors. Join us for the second part of this article coming soon, where we take a look at potential further developments as well as the opportunities that may arise for investors.

[1]https://www.fool.com/the-ascent/research/buy-now-pay-later-statistics/

[2] https://thestrawgroup.com/credit-card-killer-buy-now-pay-later-booms-with-young-americans/

[3] https://www.futureofadvice.com.au/2020/11/27/buy-now-pay-later-services-could-replace-credit-cards/

[4] https://www.finder.com/uk/buy-now-pay-later-statistics