Many marketplace platforms protect their loans through the originator with a Buyback Guarantee in order to secure the underlying investments of the investors. But is the buyback really guaranteed and does it eliminate the risks completely?

Buyback Guarantee explained

100 % safety for your money is never granted. Even if you have it in cash, it underlies economic fluctuations such as inflation. Therefore many marketplaces are protecting some of their investments with a Buyback Guarantee, or Buyback Obligation. Mintos, as an example, covers over 99 % of its loans with a Buyback Guarantee from the lending companies. The purpose of the Buyback Guarantee is to protect lenders from potential borrower defaults.

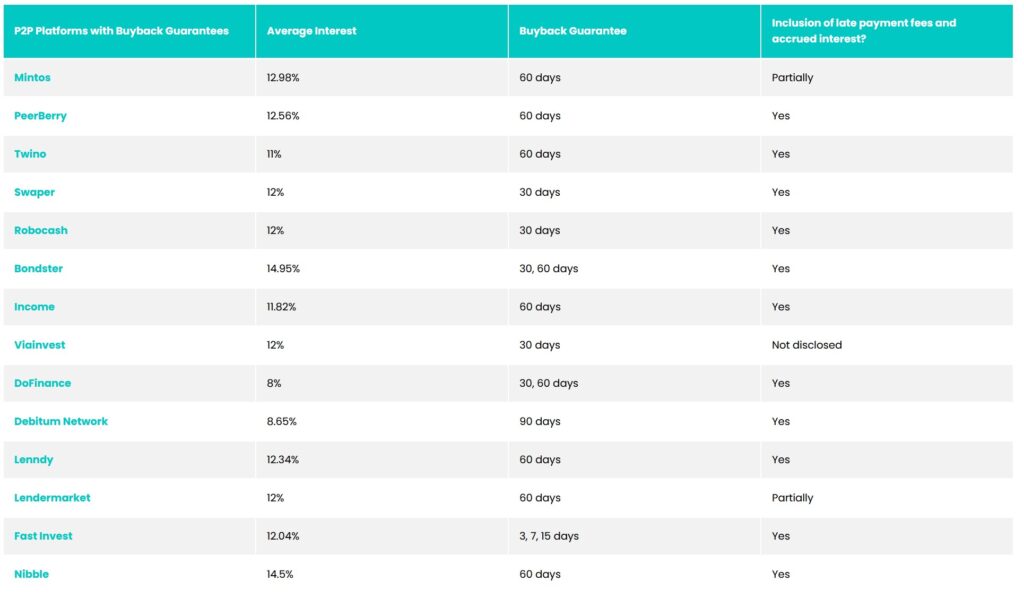

In the case of Mintos this means that if the payment from the borrower is more than 60 days overdue, the loan originator is obliged to buy back the investment plus in some cases the accrued interest. The regulations regarding Buyback Guarantees vary, however, with the maximum time period for a repayment being between 3 and 90 days depending on the chosen marketplace. [Fig.1].

Different types of Buyback Guarantees

As seen above, the conditions and terms differ from marketplace to marketplace. On Mintos, for example, the loan originators provide their own Buyback Guarantee with different terms. At Viainvest, there's the additional possibility of canceling the investment after 120 days and getting the Buyback Guarantee from the marketplace directly. At iuvo, all originators have to buy back the loans after 60 days but are not obliged to account for the accrued interest.

Group Guarantee

On some marketplaces, the loan originators even offer an additional level of protection through a Group Guarantee. In practice, this means that if a company within a group would face financial troubles, all the liabilities of that company are covered by the guarantor company. This again leads to a reduction in risk, as the risk is spread along multiple companies. Examples of companies that ensure those types of guarantees are Lendermarket with Creditstar Group or PeerBerry with Aventus Group.

Advantages of Buyback

The main benefit is derived from the increased chance of receiving the expected cash flow. If a borrower defaults and therefore can’t make the payment, it can take years to get the funds back or to reach an agreement in settling the default claim. It also spreads the risk on the loan originator and does not only affect the borrower.

Buyback Guarantee = Safety?

Mintos, the leading marketplace for loans, recently announced that they are going to change the name of their Buyback Guarantee to Buyback Obligation. This is a logical step since the word “guarantee” in the name misleads its purpose. The so-called guarantee doesn’t eliminate risk, but rather centralizes it on an arguably less risky party involved: the loan originator, or in the case of the Group Guarantee to the whole group. Nevertheless, this doesn’t mean that anything can’t happen. Examples in the past years have shown that investors haven’t always seen their money after investing in a loan with a Buyback Guarantee. This was the case with Euroscent, a loan originator on a large marketplace website, who also had a Buyback Guarantee but ended up defaulting. Envestio SI OÜ, a P2P lending platform from Estonia also had a Buyback Guarantee but declared bankruptcy in early 2020. In the particular case of Envestio, it is important to remark that the default was the result of fraudulent behavior, which is still subject to lawsuits and claims.

Risk at investing

The examples above have not only shown that the Buyback Guarantee, although certainly a useful risk reduction tool, isn’t the "be all end all" in terms of securing your investment. A key aspect that needs to be kept in mind is that: when it comes to investing, there’s always a risk. Furthermore, a Buyback Guarantee or even a Group Guarantee can only mitigate, but never fully prevent it.

This all serves as a further indication of the need for thorough investigation and diversification when compiling a portfolio. That’s why we as your partner encourage you to always do your Due Diligence for your investments. It goes without saying that this requires a specific set of skills and many years of experience in the sector of choice for your investments. This is why i2 group enables you with a possibility to save time by providing you with the needed experience and resources in the area of digital lending. We are able to provide our clients with tailor-made solutions which fit their specific needs. Our approach does not rely only on Buyback Guarantees, but integrates our biggest assets: years of expertise in the field, customizable proprietary software that can cope with any digital lending scenario, and provides market-leading reporting, auditing, controlling monitoring, and analytics services. It is with these services, that we help professional investors such as Wealth Managers, HNWIs, Family Offices, financial institutions, and many more to reach their individual goals in digital lending.