Investors are scrambling to find solutions to market volatility and valuation corrections, and private debt investing is increasing that solution.

An attractive strategy for diversification among savvy investors involves alternative asset investments that offer uncorrelated returns to traditional asset classes like stocks and bonds. Alternative lending, specifically, stands out with its unique proposition of combating inflation through fixed income, providing potentially higher yields than traditional income investing options like sovereign and corporate bonds.

However, navigating the private debt space requires careful risk management and diversification within the asset class, aided by comprehensive software solutions and investment platforms that simplify oversight, risk assessment, and portfolio management.

Diversifying your Portfolio with Private Debt

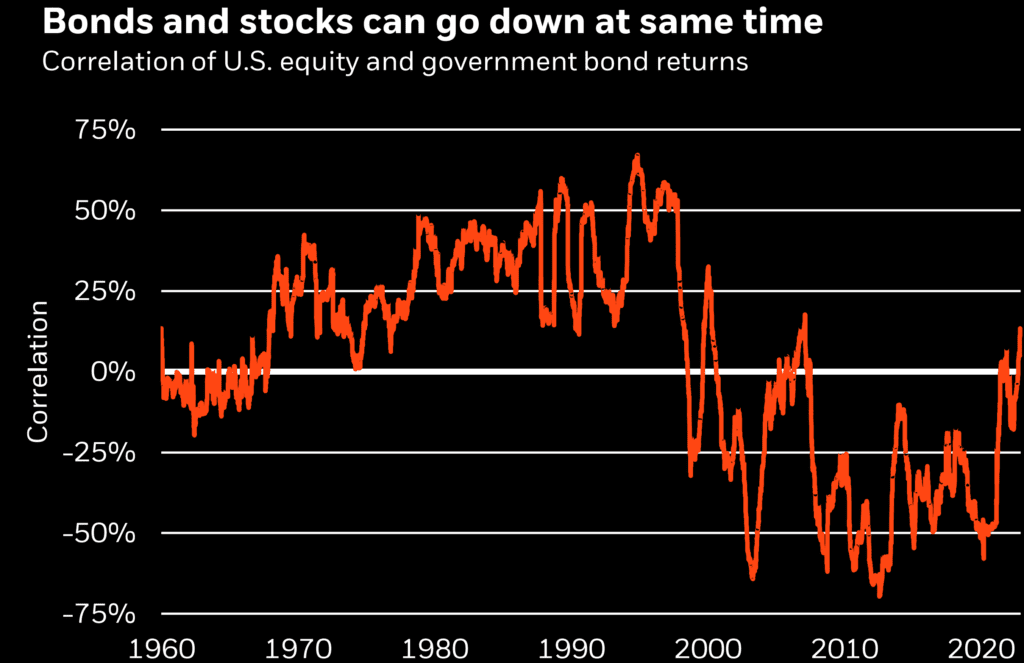

Private debt is quickly becoming a favourite amongst discerning investors, and the reasons are quickly clear when you investigate what the asset class offers today. Once the ideal blend in a diversified portfolio, stock and bonds are increasingly correlated as central banking monetary policy meddles in public equities and fixed income.

This striking lockstep leaves many investors scrambling for uncorrelated assets because, as Ray Dalio says, the Holy Grail of investing is “twenty good, uncorrelated return streams [that] dramatically reduce your risks without reducing your expected returns.”

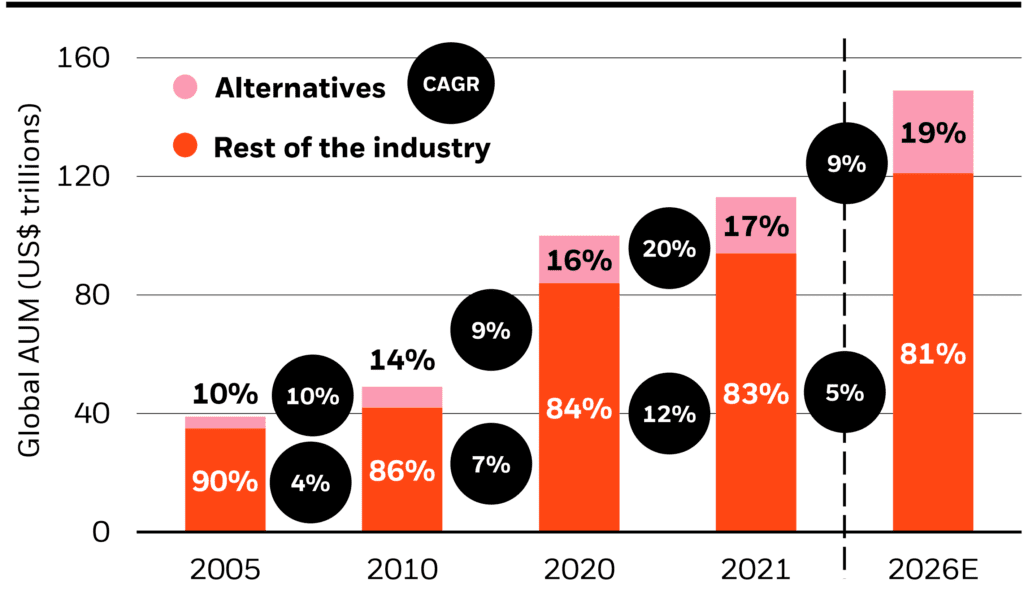

As a broad class, alternative assets offer segregation from stock and bond returns. Buoyed by a rush toward alternatives, analysts project that the net asset class will hit nearly 20% of global invested assets (about $25T) in just a few years.

But what does private credit offer investors that other alternatives like real estate, precious metals, and venture capital don’t?

Fighting inflation with fixed income

Like alternatives as a whole, the private credit and debt market is diverse, with a range of options available to suit most investment strategies, risk profiles, and other preferences. But generally, alternative lending offers a key benefit common to most specific alternative lending opportunities.

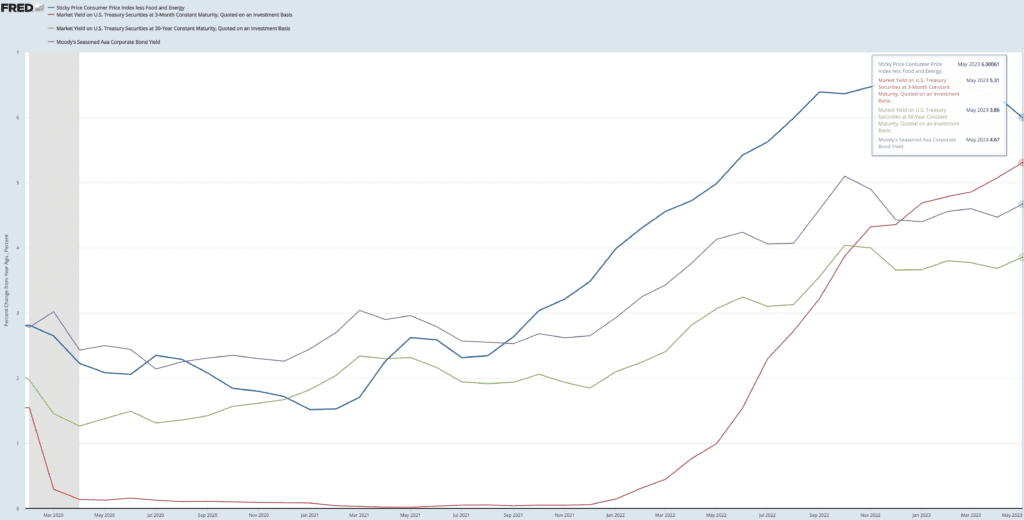

Today, although sovereign and corporate bonds generate yield for the first time in years, the higher fixed-income returns on short-term sovereign and corporate debt aren’t quite touching inflation even as the top-line number abates. And, under the ongoing inverted yield curve regime, long-term Treasuries can’t hold a candle to inflation. Ultimately, there’s no getting around the problem that reliable, predictable public income investing options can’t even preserve capital today – let alone grow your worth.

While it’s difficult to pin down an asset-wide average for alternative lending investments, you can find a predictable return beating Treasuries and inflation in nearly all cases. Of course, private lending has a higher risk of default, but these are manageable through due diligence and working through trusted industry experts.

Remember, the keyword is diversification, so maintaining a liquid and safe selection of Treasuries isn’t verboten but should be supplemented with additional yield opportunities.

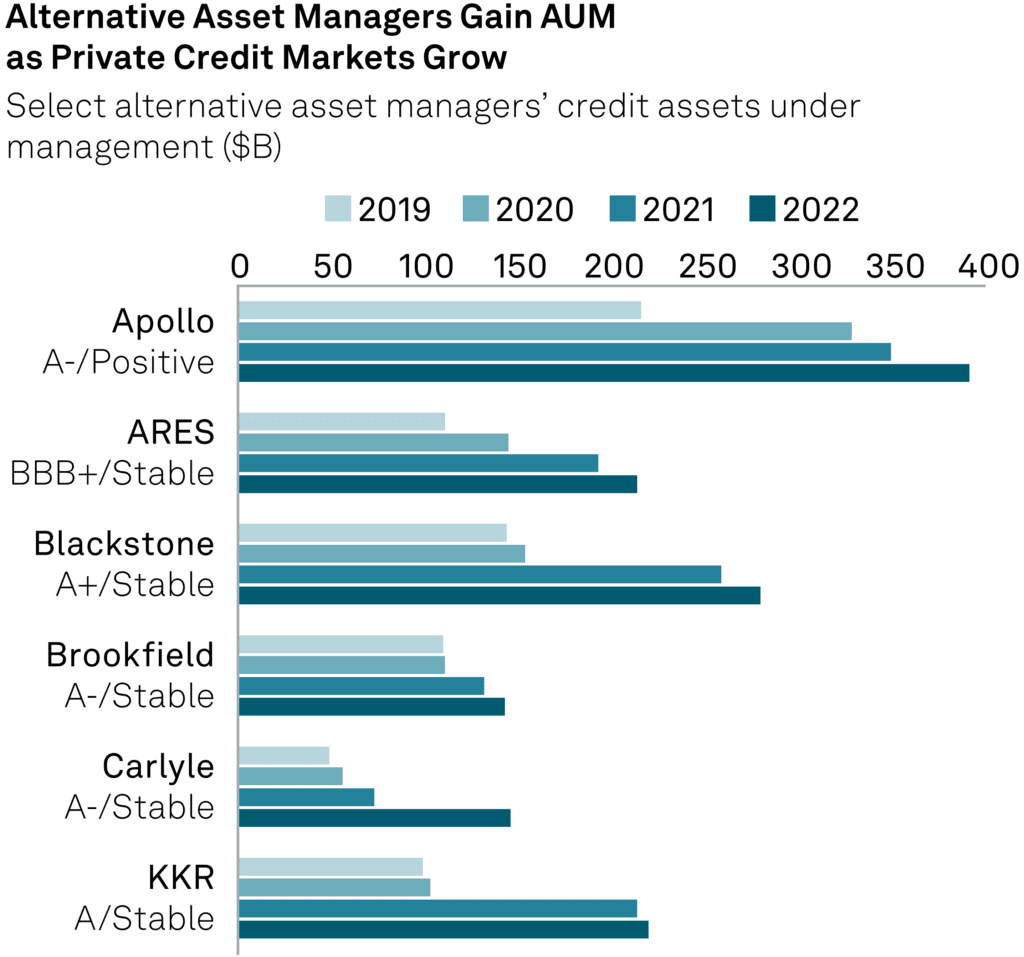

Institutional investors clearly agree, as some of the largest alternative asset funds rapidly expanded their private credit allocations since 2019:

Managing Private Debt Risk in Your Portfolio

Diversification doesn’t simply mean throwing a portion of your portfolio into alternative lending platforms and stepping away, though – you must also balance risk across private debt types and platforms, so diversifying within the asset class is also critical. Luckily, the wide range of offerings within the market offer opportunities to balance risk and return for nearly any risk profile.

While you’ll need to determine for yourself what blend of mortgage or real estate loans, BNPL offerings, invoice factoring, or any of the dozens of other options is best, there are a few critical criteria to help guide your diversification decision-making.

Regional and currency returns

Concentrating your private debt holdings in a single country, especially if it’s a high-yield debt due to systematic risk factors, isn’t advisable. Instead, like public investors have a range of emerging market, European, and American stocks in a portfolio, you should diversify your alternative lending investments by region. For example, many exciting opportunities exist in emerging markets, but going all-in on small farm agriculture loans in Africa could be disastrous if a sudden drought strikes and destroys the crops alongside your returns.

Likewise, concentrating your holdings in a sole currency could prove deficient even if used across a swath of countries and regions. With monetary and fiscal policy as complex and nuanced as they are today, avoiding currency risk by diversifying across types of legal tender is critical.

Type of loan and lender

We mentioned a few types of alternative loans, but there are many more, and access depends on several factors, including available capital, country of residence, and more. Still, managing the range of loans you select is vital to ensuring diversification. Default risk factors are the most apparent reason to do so – overconcentrating in risky BNPL loans could prove disastrous if a recession caused borrowers to halt recurring payments, and over-exposure to commercial real estate construction private credit could prove problematic if there’s a global push towards remote work.

One tool to manage risk amongst investments is exploring diversification through collateralization. Riskier loans tend to have less valuable collateral, such as vehicle title collaterals or effectively zero collateral, as in BNPL lending. Risk drives returns, but sorting your investments by low-quality collateral and more valuable collateral demands (like a farm lien option for an agricultural loan) is an easy proxy for risk assumption.

Risk factors also include liquidity concerns. Many highest-yield alternative lending investments are highly illiquid, with strict holding periods and no secondary market opportunities. Real estate lending is the most common for an apparent reason – a massive real estate loan fueling construction would be useless if investors kept pulling cash from the project budget. While allocating to these illiquid, high-return options is ideal, you should diversify your liquidity as well and hold private debt that’s easily accessible through either the lender or on secondary markets.

Managing Your Private Debt Portfolio – Problems and a Solution

So, you’ve determined a need to allocate into private lending and understand the importance of diversifying across sub-types within the asset class. But you’re faced with a nearly endless prospect of investment opportunities to pick from, let alone manage. And the problem scales with available capital, as a greater number of allocations demands greater oversight, and no centralized brokerage exists to manage these alternatives as you have for a stock portfolio.

Managing oversight, risk, and return data on Excel is very labour intensive and unreliable. Furthermore, the range of reporting requirements and legal hurdles amongst lenders mean data tends to stovepipe on specific investment platforms, complicating your ability to get a holistic, “big picture” view of your portfolio.

Innovators in the space, including i2, recognized the investor pain points and the gap in service and rushed to fill the void with comprehensive software solutions that help find, narrow down, and select alternative lending investment opportunities by nearly any criteria needed, including risk level, liquidity needs, and other preferences.

More importantly, software and solutions break apart platform monopolies that prevent accessible oversight and provide intelligence dashboards to monitor your entire portfolio within private credit, debt, and lending. Offerings vary across the industry, but you should prioritize investment software platforms that provide:

- Accessible, easy to understand, and digestible dashboard analytics. You should be able to monitor your investments at a glance without digging through multiple sub-dashboards.

- Comprehensive loan analysis tools that help group loans by selected parameters or type and let you dive into the nitty-gritty details of loans to enable due diligence before you invest.

- A no-frills but effective black box that calculates the portfolio’s total value and returns over time. Although it sounds simple, this is often the hardest feature to find because diversity in reporting amongst platforms, liquidity latency, and more prevent typical valuation techniques. Effective software negates the confusion and complexity to the point you don’t even know how hard it’s working in the background – until you try replicating it.

- Bookkeeping and tax compliance integration. While finding a true one-stop shop for portfolio monitoring and bookkeeping is hard, finding a solution that integrates with popular third-party software for ease of use is critical. Remember, there’s little benefit to centralizing the data if you export to Excel, then manually transcribe everything into QuickBooks at the end of the year.