Why is a software solution needed to manage large alternative lending portfolios?

As the alternative lending industry continues to grow and evolve, professional investors and asset managers face unique challenges in managing their portfolios effectively. The success of an alternative lending strategy heavily relies on the ability to gather, analyze, and act upon vast amounts of data promptly. To navigate these complexities, an increasing number of professional investors such as asset managers use the help of advanced portfolio management softwares. Therefore a robust portfolio management software is crucial. In this article, we explore the essential features that such software should possess to help streamline operations and maximize returns.

What features should such a software have?

Data standardization/aggregation with centralized data repository

One of the foundational pillars of efficient portfolio management is the organization and standardization of data. A comprehensive software platform should offer seamless data aggregation from multiple sources into one centralized repository. This feature allows investors and asset managers to access all pertinent information quickly, ensuring better decision-making and reducing the risk of data discrepancies. By having all data in one central place, professionals can promptly assess portfolio health and identify potential opportunities and risks.

Centralized reporting

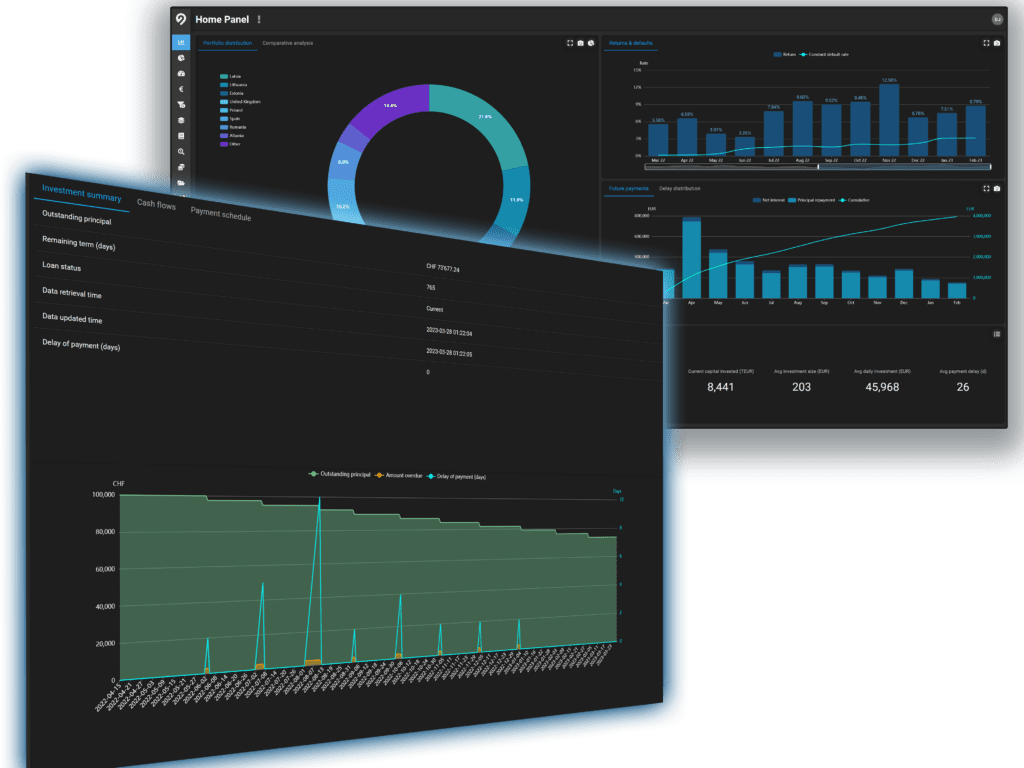

Effective portfolio management necessitates access to timely and comprehensive reporting. A reliable software solution should offer a centralized reporting dashboard that provides real-time insights into portfolio performance, exposure, and key metrics. Centralized reporting streamlines the monitoring process, offering a holistic view of the portfolio's health and performance. Investors and asset managers can promptly identify underperforming assets, assess risk exposure, and make data-driven decisions to optimize returns.

Audit trail for enhanced transparency

Transparency and accountability are essential in the alternative lending industry. An audit trail is a crucial feature that tracks every action, modification, or decision made within the software platform. An audit trail not only facilitates compliance with regulatory requirements but also ensures transparency with stakeholders. It allows for a clear and transparent record of decisions, changes, and activities, mitigating the risk of potential disputes or legal issues.

Cash flow projections

Alternative lending portfolios often consist of various assets with different maturities and cash flow patterns. To ensure effective liquidity management, a comprehensive software platform should offer accurate cash flow projections. Cash flow projections help investors and asset managers plan for future liquidity needs, anticipate cash inflows and outflows, and make informed decisions regarding investment strategies and redemption management.

Historical data and projections

Robust historical data analysis is essential for understanding portfolio performance over time and identifying trends or patterns that may impact future decisions. Additionally, a reliable software platform should offer the ability to create projections based on historical data. Historical data analysis helps investors and asset managers identify long-term performance trends, make informed projections, and adjust their strategies based on past experiences, increasing the likelihood of positive outcomes.

Comprehensive data storage

In the alternative lending sector, managing paperwork and documentation is a significant challenge. A comprehensive software platform should include a data storage feature to organize and secure essential documents such as loan contracts, borrower data, collateral documentation, KYC/AML records, and more. Data storage capability streamlines operations, reduces the risk of document loss, enhances regulatory compliance, and facilitates quick access to critical information during audits or due diligence processes. Beyond all of this, such a feature also increases efficiency allowing for faster operations and processes.

Access to individual loan data

For effective portfolio management, investors and asset managers must have granular insights into individual loans within the portfolio. A sophisticated software solution should offer access to individual loan data, including borrower information, repayment history, and asset details. Access to individual loan data enables professionals to perform in-depth analyses of loan performance, assess credit quality, and identify potential risks associated with specific loans or borrowers.

Accrual calculations and tracking

In the realm of alternative lending, the incorporation of an accrual mechanism for interest and fees stands as a pivotal cornerstone. This mechanism not only upholds financial accuracy but also fosters comprehensive insights into the true value and performance of a lending portfolio. By accurately tracking and accruing interest and fees over time, the software empowers lenders to make informed decisions, optimize cash flow projections, and maintain transparency with stakeholders. This not only enhances risk assessment but also refines strategic planning, enabling portfolio managers to adapt and thrive within the dynamic lending landscape. Ultimately, an accrual mechanism in such software transcends mere accounting practice, evolving into a strategic tool that fortifies portfolio health, nurtures investor trust, and amplifies the potential for sustainable growth.

Provisions with custom criteria

Automating the provisioning process is essential for managing risk effectively. A robust software platform should allow investors and asset managers to set up custom criteria for provisioning, considering factors like borrower creditworthiness, collateral quality, and market conditions. Customizable provisioning criteria enable risk managers to adapt their strategies based on specific lending scenarios, leading to improved risk management and optimized portfolio performance.

Conclusion

In the ever-changing landscape of alternative lending, professional investors and asset managers require robust software solutions to effectively manage their portfolios. By integrating the features discussed in this article nvestors can gain a competitive edge.

Such a software platform not only enhances decision-making but also improves transparency, reduces operational risks, and ensures regulatory compliance. By investing in the right portfolio management software, alternative lending professionals can position themselves for success and achieve their financial objectives.

See for yourself what our software can do for you and what our clients say. Interested? Get in touch with us or schedule a demo!