The traditional banking sector has been disrupted as alternative lending platforms have gained prominence, leading to a significant transformation in the financial services landscape. Alternative lending models such as marketplace lending, peer-to-peer (P2P) lending, and digital lending have emerged to cater to the changing requirements of borrowers and investors. Now, let's delve deeper into the growing popularity of alternative lending and the crucial factors that are attracting institutional and professional investors to these cutting-edge investment opportunities.

Low correlation to other investment tools like Equities, Bonds, Commodities

Institutional and professional investors are drawn to alternative lending as an investment option primarily due to its limited correlation with traditional asset classes like equities, bonds, and commodities. This unique characteristic allows investors to diversify their portfolios effectively and safeguard against market downturns. By incorporating alternative lending into their investment strategy, investors potentially reduce the overall volatility of their portfolios, mitigating the impact of market fluctuations on their returns.

Alternative lending platforms employ advanced data analytics and risk assessment tools to effectively enhance risk exposure management. These tools enable a more accurate evaluation of borrower creditworthiness, leading to enhanced risk management and more precise risk-adjusted returns.

Overall, the low correlation with traditional investment securities presents a valuable opportunity for institutional and professional investors to optimize their portfolios and achieve superior risk-adjusted performance.

High potential yield, diversification of portfolio, and increased client demand

Alternative lending presents investors with an appealing risk-return profile, offering the potential for higher yields compared to traditional investments. It also provides diversification benefits, enabling investors to spread their risk and optimize the performance of their portfolios.

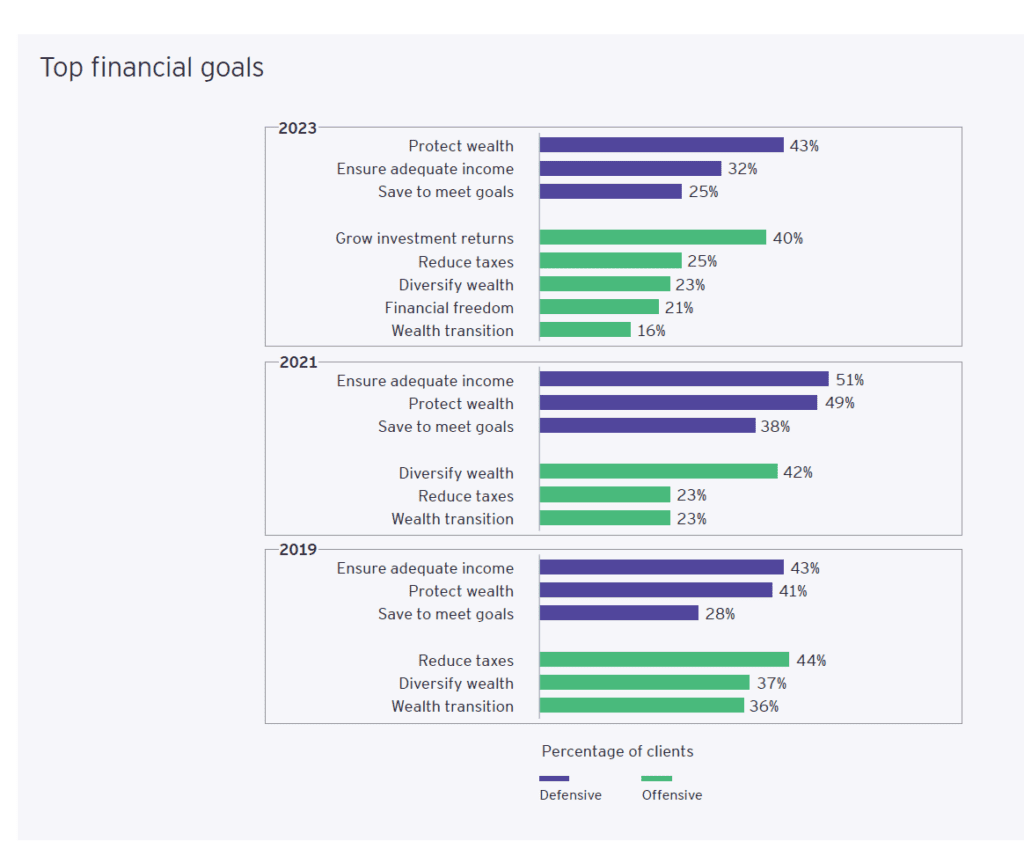

Recent trends have shown that many (U)HNW clients of wealth- and asset managers show increased interest in diversifying their portfolio with alternative investments. This is coupled with a growing interest in increasing investment returns.

The rise of financial technology (fintech) companies has further fueled the growth of alternative lending. These platforms leverage cutting-edge technology and data analysis to provide more efficient and customized lending solutions.

In this ever-changing investment environment, alternative lending stands out as a promising option for investors looking to diversify their portfolios and achieve attractive risk-adjusted returns.

With this in mind, alternative lending offers great opportunities for wealth- and asset managers to satisfy their client’s needs, allowing for further portfolio diversification while capitalizing on the potential rewards offered by this innovative asset class.

Why does alternative lending exist?

Alternative lending has emerged as a response to the changing financial landscape, with traditional banks reducing their lending activities, particularly for smaller loans to SMEs. This reduction has created an opportunity for alternative lending platforms to step in and bridge the gap. These platforms provide borrowers with fast access to funds through simplified application processes and quicker decision-making. The convenience and speed offered by alternative lending makes it an appealing choice for borrowers seeking capital.

The rise of alternative lending can also be attributed to the broader trend of transitioning to a more digital and interconnected financial ecosystem. As technology continues to revolutionize the financial services industry, alternative lending platforms have become significant participants in this transformation.

They harness the power of data, automation, and machine learning to deliver a lending experience that is more seamless, transparent, and customer-centric. Alongside filling the funding void left by traditional banks, these platforms are driving innovation in the financial sector and reshaping how businesses and individuals obtain credit.

What are some of the main misconceptions about alternative lending?

- Alternative financing is exclusively for businesses with poor credit: There is a common misunderstanding that alternative financing options are only intended for businesses facing credit challenges. In reality, alternative financing encompasses a wide array of options suitable for businesses with diverse credit profiles, including those with strong credit histories.

- Alternative financing is excessively costly: Another misconception is that alternative financing comes with exorbitant interest rates and fees. While certain alternative financing options may carry higher costs compared to traditional bank loans, it's important to consider the unique advantages they provide, such as flexibility, speed, and access to funds, which may outweigh the slightly higher expenses.

- Alternative financing lacks credibility and reliability: Some believe that alternative financing providers lack the credibility and stability of traditional financial institutions. However, the alternative financing industry has experienced significant growth and maturity, with established platforms, reputable lenders, and regulatory frameworks in place. Many alternative financing providers have earned trust and recognition, offering dependable and transparent services to businesses seeking financing.Moreover, the sector is experiencing a growing number of regulatory developments that contribute to the increased investment focus in this area. One such illustration is the European Crowdfunding Service Providers Regulation (ECSPR). ECSPR aims to create consistent regulations throughout the European Union concerning investment- and lending-based crowdfunding services. By implementing a unified set of rules, platforms can seek an EU passport, simplifying their ability to provide services across EU countries.

General Pros and Cons

Pros:

- Diversification: Alternative lending allows investors to diversify their portfolios, reducing overall risk and volatility.

- Higher potential returns: Alternative lending investments can offer higher yields compared to traditional lending investments.

- Low correlation: These investments are less impacted by fluctuations in traditional asset classes, providing a hedge against market downturns.

- Better risk projections:Investors can enhance their understanding of risk projections through the aid of technology. Discover more about solutions like i2 group that offer such assistance to investors. Explore further details about these solutions at this source.

- Innovation and disruption: Alternative lending platforms are at the forefront of financial innovation, creating new investment opportunities.

Cons:

- Platform risk: The failure or mismanagement of an alternative lending platform can lead to significant losses for investors.

- Regulatory risk: Regulation changes can impact the growth and profitability of alternative lending platforms and investments.

- Liquidity risk: Alternative lending investments may not be as easily liquidated as traditional investments, which may lead to difficulties in cashing out or rebalancing a portfolio.

Fortunately, there exist solutions to address and resolve these risks. By utilizing the software solution provided by i2 group, investors can effectively reduce the chances of encountering liquidity risks and mitigate the potential mismanagement of alternative lending platforms. Gain a deeper understanding of how i2 group delivers professional strategic support by exploring further information.

Conclusion

The attractiveness of alternative lending to investors has been on the rise due to its potential for generating high yields, providing diversification benefits, and exhibiting a low correlation with traditional asset classes. With increasing demand for alternative investments among ultra-high-net-worth (UHNW) and high-net-worth (HNW) clients, alternative lending platforms are in a favorable position to take advantage of this trend.

Nonetheless, investors must exercise caution and be cognizant of the risks associated with alternative lending. It is crucial for them to carefully evaluate their risk tolerance and investment objectives before venturing into this emerging asset class.

Despite enduring a prolonged period of substantial macroeconomic uncertainty, the private debt asset class perseveres and demonstrates continuous growth and resilience. Moreover, the increasing adoption of regulations suggests that it's just a question of time until the alternative lending market becomes widely accepted.